Education Cost Benefit Analysis - Is College and Higher Education Worth It

Americans are worried about unemployment, frustrated by recession, choking in mountains of debt and are worried and uncertain about the future. Is it any wonder that young people and their parents throughout the world are asking: Is technical, college and other education beyond high school worth it in the long run?

Higher education fees have risen generally and Private college fees have risen 70 % over the last ten years, which is double the rate of inflation. Public college tuition and other fees have more than doubled in ten years.

Students and their parents are burdened with huge debts that are getting larger and larger and are taking much longer to pay off. In many cases these debts prevent young people from buying their own home because they cannot get a mortgage while they have existing debts.

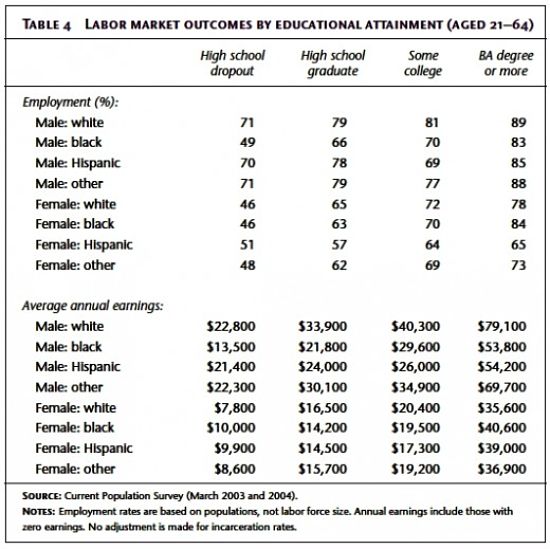

However higher education is still a good but risky lifetime investment for many people. A four-year higher degree, or prolonged technical training is still great insurance for increasing job prospects and income, especially in a tough job market. Recent unemployment figures show that people with a bachelor’s degree or higher had an unemployment rate of 4.5 percent, less than half the 10.1 percent for people with only high school education. Getting a job has become the primary driver for higher education.

Higher education is still a very risky investment and there are many things to consider apart from the increased chances of getting a job.

Some economists have argued that the tide has changed and that the investment in education is now too risky, and that people should cancel college and avoid the debt associated with it.

Some of the points raised for and against this are:

- Parents should give their children cash or investment funds to start a business rather than sending them to college.

- Most skills required for many jobs are acquired on the job rather than in education institutions. There has been a move to change legal training back to an apprentice type system as a junior clerk with a law firm rather than through a law degree. Many law graduates claim that they learnt virtually nothing at College, compared with the experience they gained during part-time work in the last two years of their degree.

- The internet has made fundamental changes to the availability of information and its analysis. Much of the information in text books is now widely available online. There are now a wide range of online tools for doing many of the calculations that engineers and architects had to learn to do by hand.

- Many jobs have been de-skilled. Just look at plumbing. Apprentices used to have to learn to put threads on the end of metal pipes and design complex plumbing systems. Now plumbing is simply a matter of pick the plastic fittings and glue them together.

- At the same time may people have argued that higher education is too focused on jobs and has neglected the need for teaching broader aspects of education. Many have pushed for broadening medical courses into areas that teach doctors to relate better with their patients and to have business skills.

- Even the job of orthodontists and dentists has been de-skilled. Orthodontists used to have to build the teeth braces for each individual tooth and person. Now it is all done with tiny pads stuck to teeth with glue. The wire systems and straightening strategies are most designed by computers using images of the jaws.

- In the 'dump and replace' age - many jobs requiring technical training have gone. Very few computers are repaired any more - broken ones are simply replaced under warrantee. For older machines the faulty circuit boards are simply replaced. Often a repairer will simply replace each of the circuit boards in turn until the computer of peripheral works.

- Despite the low interest rates many student loans are equivalent to a mortgage and many graduates could pay back double their student loan.

- Two-thirds of college students in the US borrow to pay for college, and their average debt is twice what it was ten years ago when only about 60% of students had a loan.

- The individual loans cane be huge ranging from $25,000 to almost $200,000 for a 5 year program.

- A 2006 survey of 1,508 graduates less than 35 years of age, showed that nearly half of them estimate that it will take more than 10 years to pay off debt. About 40% of subjects in the study claimed that they had delayed buying a house because of their student loans, while about 30% said that the debt had delayed having children.

- Many graduates struggle to get jobs that pay enough to enable them to pay off their loans quickly. The debt also stops them taking risks in applying for other jobs in case the job fails.

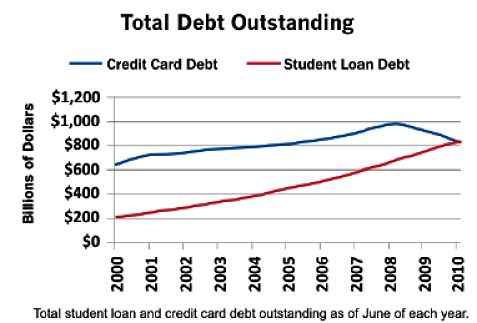

- In USA the total student loan debt has now risen above credit card debt for the first time, which exemplifies the debt burden placed on students.

- All the news about long-term unemployed young people, who are burdened with more than $90,000 of college debt is discouraging some young people from attending college.

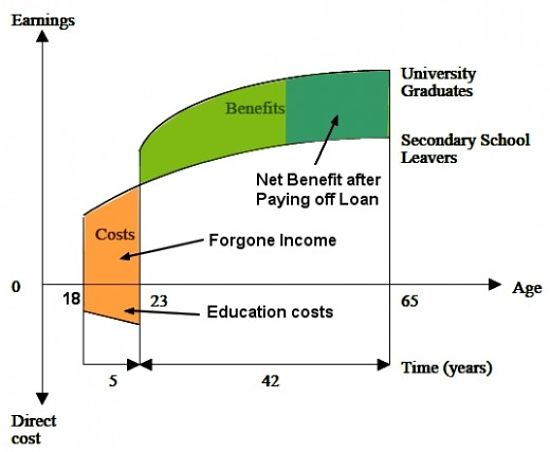

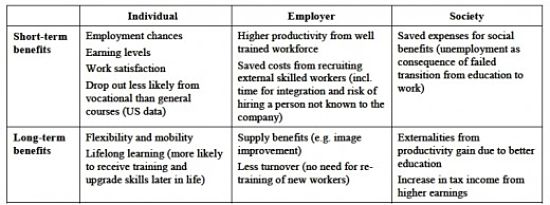

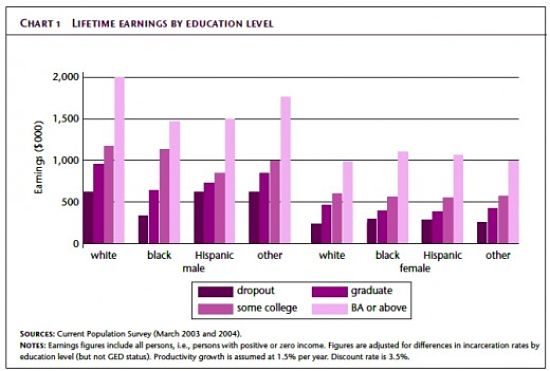

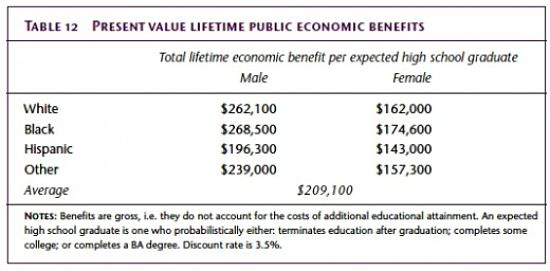

However despite the gloom, college and other higher education still stacks up as a good investment over a lifetime. The first image below summarise the costs and benefits of a higher education. The second image summarize the broad scale benefits of vocational education from various perspectives. The other images summarizes the benefits in terms of employment and lifetime salaries.