Find Positive Cash Flow Investment Properties Using Sniffer WebApp

The holy grail of investing in rental properties is Positive Sash Flow, that is, properties that provide a net monthly income from rent after all the costs are paid. While there are many tools for calculating mortgage repayments for various interest rates the long term costs of the investment can be very hard to estimate.

These costs include local rates, property management fees, insurance, allowances for repairs and maintenance, costs to maintain the grounds, land tax, and administrative costs such as postage, phone, travel for inspections and many other minor costs.

Depreciation of hot water units, air conditioning and heating equipment, furniture and fittings, are regarded as income for calculating net cash flow.

Depreciation and total costs for the investment can be very difficult to estimate especially when comparing different types of properties such as houses, flats, apartments and multi-unit blocks of various types. The Sniffer WebApp allows these costs to be estimated and later compiled from real data for estimating the cash flow from various property investments.

Sniffer WebApp - An Online Tool for Finding Positive Cash Flow Properties

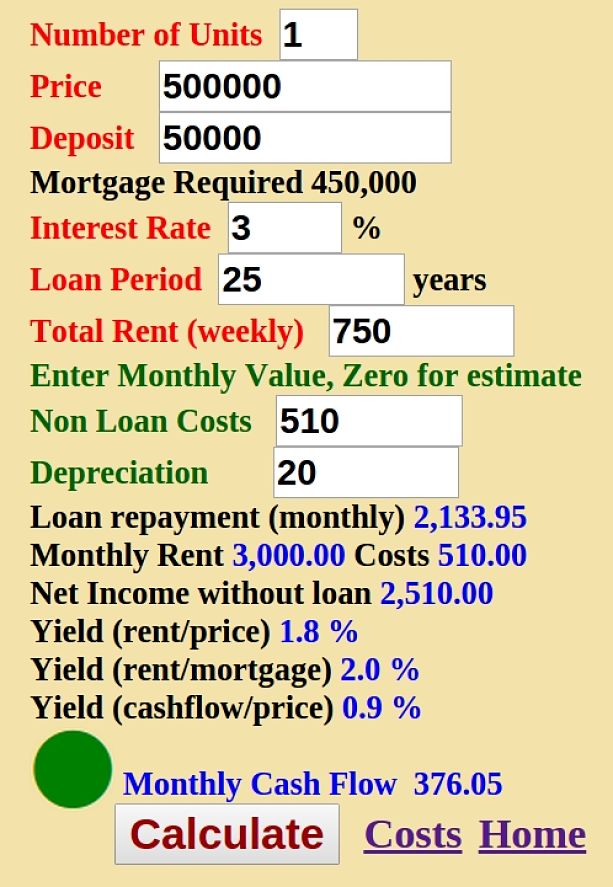

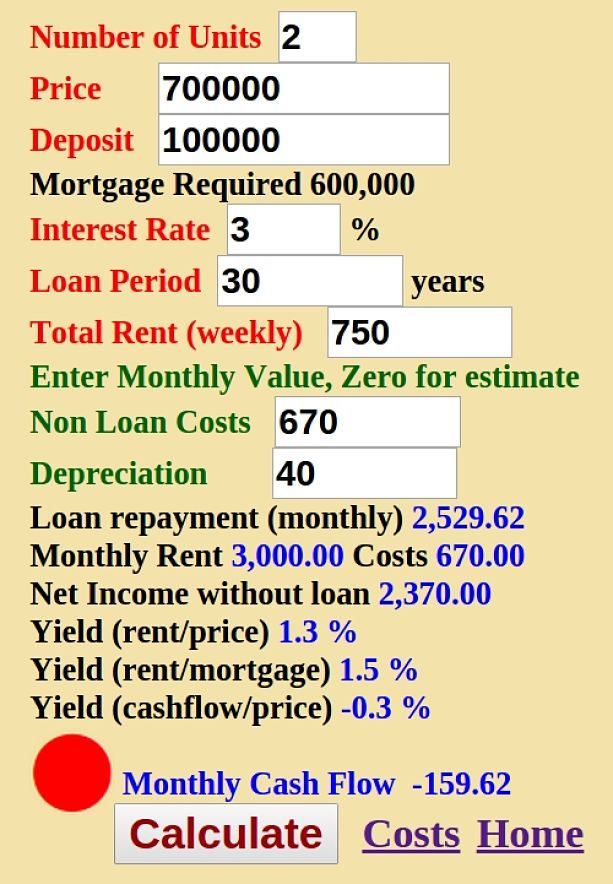

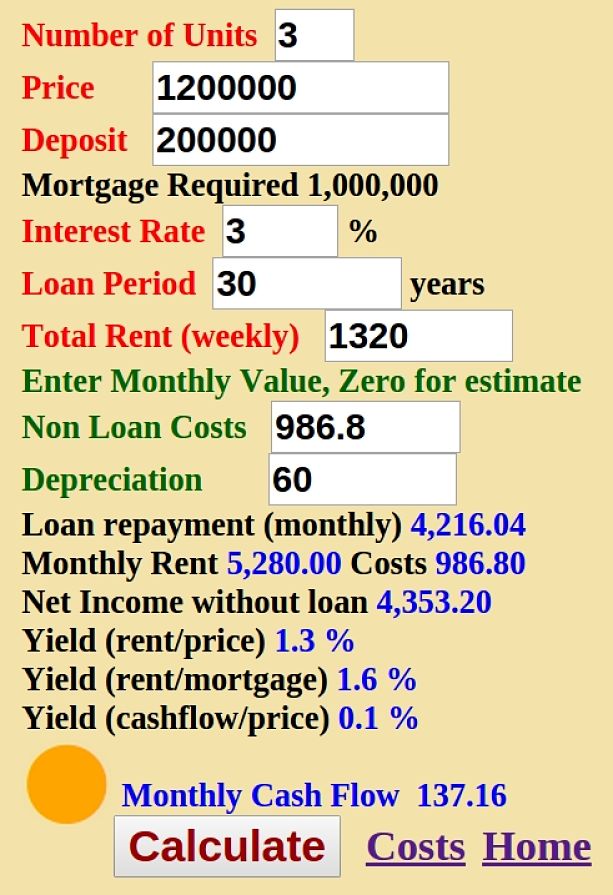

The WebApp 'Sniffer' has been designed to provide ball-park estimates of net costs and depreciation using simple formulae. You can enter the price of the property and the deposit, the interest rate and period of the loan and Sniffer will provide a rough estimate of the total costs. Once you enter the rental returns for the property, Sniffer provides an estimate of the net cash flow for the property.

A traffic light system of 'red', 'amber' and 'green' symbols is provided so you can quickly compare a set of listed properties in terms of their predicted cash flow. Properties given a 'Red' symbol have a negative or very small net return. Properties labelled 'Amber' have a low positive cash flow. 'Green' properties have a moderate to high cash flow estimate. These properties can be short-listed for further assessment. This includes getting real estimates of the cost.

Examples

Cost Estimates

If you enter 'zero in the 'Cost' and 'Depreciation' text boxes the tool will provide simple estimates for the costs.

The estimates depend on the number of units or flats in the block.

Obviously, the costs per unit for a property that has more than one flat or apartment will be less.

For example, the cost of maintaining the grounds and exterior of the building will be shared between the apartments.

Blocks of flats are more likely to have positive cash flow returns because there are multiple rents and lower costs.

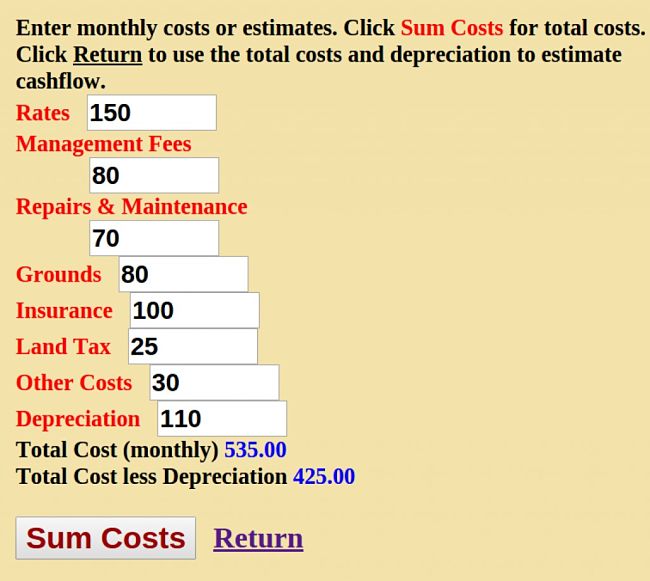

Entering Costs

Sniffer provides a form for entering the costs (see the image below).

The total costs and depreciation estimates can then be fed back into 'Sniffer' to make a more reliable estimate of cash flow and yield for the properties.

Investment Yield

The tool calculates three yields:

- Gross Rental Yield - the Annual income as Rent divided by the Price as a percentage.

- Yield for the Mortgage- the Annual income as Rent divided by the Mortgageas a percentage.

- Net Rental Yield or Cashflow Yield- the Annual rental income less the total Annual expenses, divided by the Price as a Percentage.