Manage Tight Budgets Using Money Partitioning, Earmarking, Portions

Some people are familiar with the concept of partitioning that applies to permanently allocating part of your hard-disk for certain tasks. For budgets,

it is doing the same thing by partitioning your income into the equivalent of labeled envelopes.

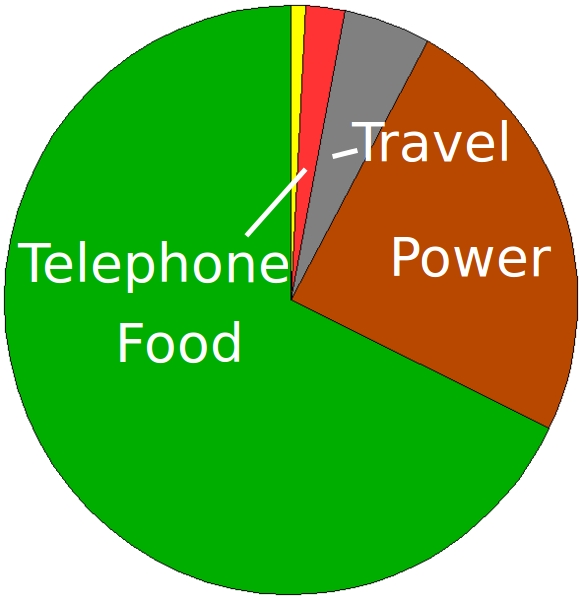

The idea is to partition your income or allocate it to pigeon holes for various costs such as your power and

telephone bill. What is left is your so-called 'disposable income'.

This is the money you can spend on non-essential items. This is the opposite of paying everything

using a credit card which can lead to overspending.

If you partition your money there will be a fixed amount set aside for each cost and you will be less likely to

overspend. Stealing from the 'power bill' envelope to pay for clothes will be much harder to do

than dipping into a single pile. The more partitions of portions you have the harder it will be to

overspend as the 'stealing' will get tougher and tougher. Partitioning can work within budget items as well.

For example you may go to the supermarket with separate envelopes for meat, vegetables, breakfast foods and other

items. This allows you to take control of your spending. This article reviews the current research on partitioning

budgets and using portions to control spending.

Partitioning and Earmarking Budgets Prevents Overspending and Helps controls Budgets

Research Shows that Partitioning is Effective in Controlling Consumption

A recent study showed that subdividing a resource such as food or money into smaller units by partitioning

or using smaller portions reduced both the amount consumed and the rate of consumption.

Another study examined the effectiveness of 'earmarking'

Another study examined the effectiveness of 'earmarking'

, that is the labeling of money set aside for a particular purposes.

This strategy increases the number of decision-making opportunities during which control can be exerted.

These research studies demonstrated the effectiveness of partitioning for consumption of chocolates and gambling.

Earmarking Funds for Particular Purposes

Specifically, earmarking pre-commitments certain proportions of the budget and this helps control expenditure. Some people have multiple accounts that they can send funds to, but generally extra accounts, means extra administration costs. There are many smartphone apps for tracking expenditure against various budget items. However, tracking is not the same and partitioning. It would be good if you could partition with a single bank account, but you can't do this with most accounts. Some organisations allow you to set up automatic debits to pay for mortgages and car loans, etc, but once again these are limited.

Some people do the partitioning with cash, either within pockets in their wallets or a set of jars or envelopes at home. These work well for some people. Such interfaces are relatively inexpensive to design and can be used to scale up the kind off interventions we study in our field experiment to larger populations.

Multiple partitions for earmarked purposes has another major benefit. It stops 'robing Peter to pay Paul'. The more partitions there are the more 'guilt' builds up as the partitions are raided for uses other than those designated.

Controlled Portion Sizes to Regulate Consumption

If you buy a huge bag of popcorn at the movies and eat the lot you may feel guilty afterwards if you are on a diet. If the same volume of popcorn was subdivided into 10 smaller bags, you may be less likely to open and eat each one. There is more incentive to stop, and it is obvious that you are consuming more than you need or want to eat. Splitting food and other things into smaller portions helps control what you eat. The same applies to budgeting. If you have allocated $20 for snacks and you take the entire amount to the shops, you will be more included to spend more of it. If you exchange the single $20 into four $5 notes, you will restrict your spending if you only take $5 to the shops.

Identify Your Discretionary Income After Partitioning

One huge advantage of partitioning is that you know how much you have to spend on yourself after your have set aide money for the power, telephone and other items. Once you know the limit you will also be wider about what you choose to spend it on.

Review Your Allocation Frequently

One last advantage of partitioning is that it allows you to check the amounts you have set aside and to make adjustments. Perhaps your power bill will increase during winter and decline in summer. You may also want to save some funds each week for a 'rainy day' or for unexpected things you have not budgeted for.

Conclusion

Partitioning and Portion Control are not new concepts. Perhaps your grandparents used envelopes or glass jars for budgeting. In the 21st century there is a desperate need for methods to partition within bank accounts to complement the wealth of budgeting apps that are available for smartphones.